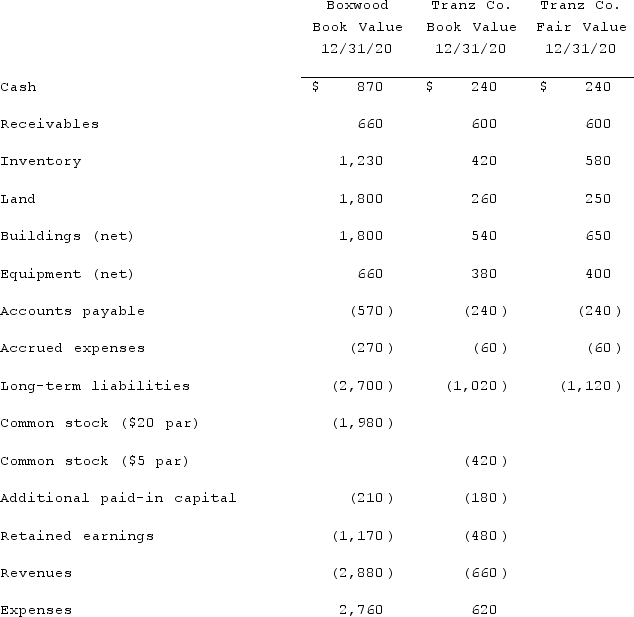

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated inventory immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated inventory immediately following the acquisition.

Definitions:

Expectancies

What someone expects to happen, based on past experiences of what was rewarding.

Rewards

Benefits or positive feedback received as a result of an action, which serve as reinforcement for that behavior.

Punishment

The imposition of an undesirable or unpleasant outcome upon a group or individual, in response to a behavior deemed unacceptable or unsatisfactory.

Unconditioned Stimulus

A stimulus that naturally and automatically triggers a response without any prior learning.

Q6: The process of identifying and assessing what

Q33: When a parent company acquires a less-than-100

Q55: Town Co. appropriately uses the equity method

Q60: The newly opened Stone Restaurant was unable

Q81: Which of the following is the first

Q90: Following are selected accounts for Green Corporation

Q90: As output is increased or decreased,the _

Q93: On January 1, 2021, Harrison Corporation spent

Q103: Flynn acquires 100 percent of the outstanding

Q116: In measuring the noncontrolling interest immediately following