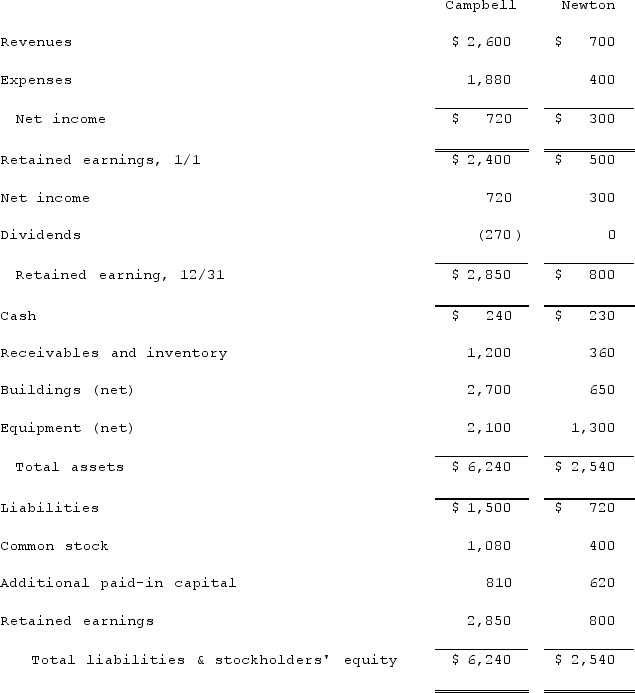

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the goodwill arising from this acquisition at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the goodwill arising from this acquisition at December 31, 2021.

Definitions:

Margin Of Safety

The difference between the actual or expected profitability of a project and the break-even point, often used as a risk assessment measure.

Contribution Format

An income statement format that separates fixed and variable costs, highlighting the contribution margin.

Income Statement

An accounting document reflecting a business's earnings, outlays, and gains for a particular period.

Tile Manufacturer

A company specializing in the production of tiles, which are pieces of hard-wearing material such as ceramic, stone, or metal used for covering roofs, floors, walls, or other objects.

Q25: Chase Incorporated sold $260,000 of its inventory

Q46: When customers try to pit suppliers against

Q56: With respect to recognizing and measuring the

Q59: Which statement is true of the developing

Q59: Google+ Hangouts,a popular facet of the fledgling

Q71: On January 1, 2021, the Moody Company

Q84: When the fair value option is elected

Q92: Which of the following is false regarding

Q95: On January 1, 2019, Palk Corp. and

Q114: The 99-Center is a retail store where