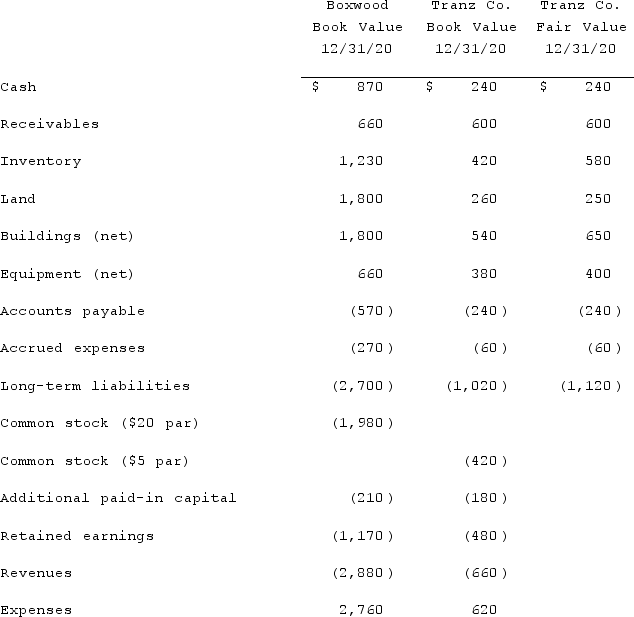

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated goodwill immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated goodwill immediately following the acquisition.

Definitions:

Meteorite

A fragment of a meteoroid that has fallen to a planetary surface.

Dried Up

Refers to something that has lost all its moisture.

Natural Stain

A discoloration or marking often found on materials, caused by the chemical or physical reaction of a natural substance.

Fractures

Breaks or cracks in rocks where there has been no significant movement or displacement of the sides relative to one another.

Q6: Renz Co. acquired 80% of the voting

Q10: A parent acquires all of a subsidiary's

Q14: Panton, Inc. acquired 18,000 shares of Glotfelty

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q32: Bassett Inc. acquired all of the outstanding

Q63: Discuss the effects of advertising on consumers

Q66: When an investor appropriately applies the equity

Q73: Manchester Classics manufactures apparel for men and

Q75: Flynn acquires 100 percent of the outstanding

Q95: During 2021, Miner Co. sold inventory to