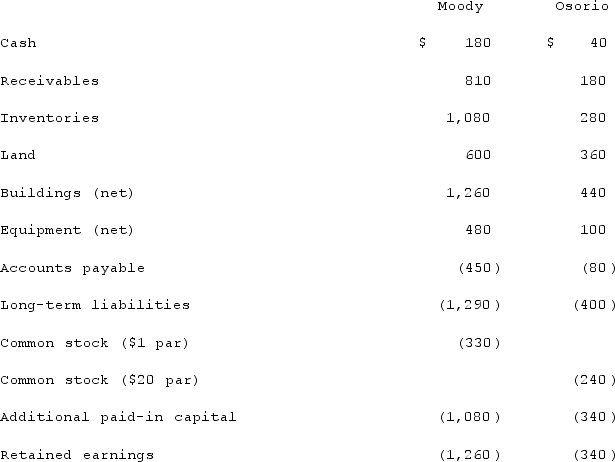

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Market Supply

Market Supply refers to the total amount of a specific good or service available to consumers in a market at a given price over a certain period.

Minimize Profits

The strategy or outcome where a business seeks to make the lowest possible profit, often for tax, regulatory, or strategic reasons.

Maximize Profits

The process of adjusting operations and resources to achieve the highest possible profit.

Break-even

The point at which total cost and total revenue are equal, meaning no net loss or gain is incurred by the business.

Q8: Acker Inc. bought 40% of Howell Co.

Q11: A touch point that customers encounter in

Q23: Cayman Inc. bought 30% of Maya Company

Q35: What is the purpose of Consolidation Entry

Q59: Unlike break-even pricing,markup pricing uses complicated concepts

Q60: On January 1, 2021, Bangle Company purchased

Q85: When a parent uses the initial value

Q89: When Valley Co. acquired 80% of the

Q91: Which of the following is not a

Q107: How does a parent company account for