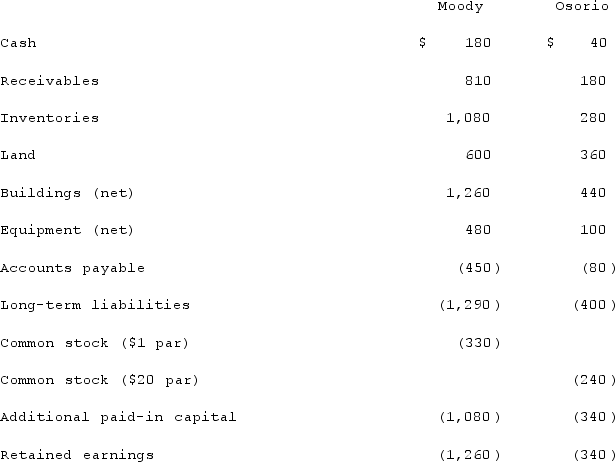

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.If Osorio retains a separate corporate existence, what amount was recorded as the investment in Osorio?

Definitions:

Dissociative Amnesia

A disorder characterized by the inability to recall important personal information, usually of a traumatic or stressful nature, that cannot be explained by ordinary forgetfulness.

Retrograde Amnesia

Loss of memory from the point of some injury or trauma backward, or loss of memory for the past.

Psychological

Pertaining to the mind or mental processes, involving emotions, behavior, and cognitive functions.

The Exorcist

A horror film directed by William Friedkin, based on the novel by William Peter Blatty, centered around the possession of a young girl and her exorcism.

Q16: On January 3, 2021, Roberts Company purchased

Q34: Which of the following is involved in

Q43: When Valley Co. acquired 80% of the

Q49: When a company applies the initial value

Q75: McGraw Corp. owned all of the voting

Q80: Which of the following refers to any

Q87: Jernigan Corp. had the following account balances

Q102: On January 3, 2021, Roberts Company purchased

Q109: Presented below are the financial balances for

Q111: Anderson Company, a 90% owned subsidiary of