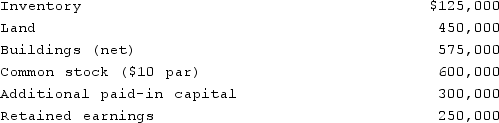

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will the consolidated common stock account be as a result of this acquisition?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will the consolidated common stock account be as a result of this acquisition?

Definitions:

Hard Facts

Objective, concrete information that is not influenced by feelings or interpretations.

Competitive Advantage

The unique attributes or circumstances that enable a business to outperform its competitors.

Evidence-Based Management

An approach to management based on the conscious use of the best available evidence to make decisions.

Local Context

The specific environmental, cultural, economic, and legal conditions in a geographical area that influence business operations and strategy.

Q7: Which of the following is a social

Q59: Google+ Hangouts,a popular facet of the fledgling

Q65: The balance sheets of Butler, Inc. and

Q69: Blogs that are sponsored by a company

Q76: Webb Company purchased 90% of Jones Company

Q82: Pot Co. holds 90% of the common

Q93: On January 4, 2020, Nelson Corporation purchased

Q98: On January 1, 2021, the Moody Company

Q98: How are intra-entity inventory transfers treated on

Q121: Fesler Inc. acquired all of the outstanding