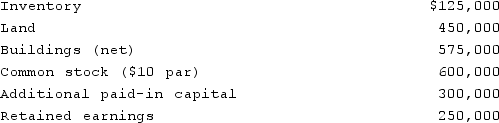

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

Definitions:

Foreign Exchange Risk

The potential change in earnings or financial position from fluctuating exchange rates affecting international financial transactions.

Forward Contract

An agreement to buy or sell an asset at a future date for a price agreed upon today.

Spot Rate

Refers to the immediate exchange rate at which one currency can be exchanged for another without any delay.

Fair Value Hedge

A type of hedge that is used to mitigate the risk of changes in the fair value of an asset or liability or an identified portion of such an asset or liability.

Q1: A _ is a price reduction offered

Q8: Key Company has had bonds payable of

Q10: Prices always steadily decline for a product

Q26: A term that describes a company that

Q29: How does the equity method of accounting

Q34: Panton, Inc. acquired 18,000 shares of Glotfelty

Q48: When Lofonift Inc.introduced its flagship MP3 player,it

Q69: Blogs that are sponsored by a company

Q90: As output is increased or decreased,the _

Q96: Under the initial value method, the parent