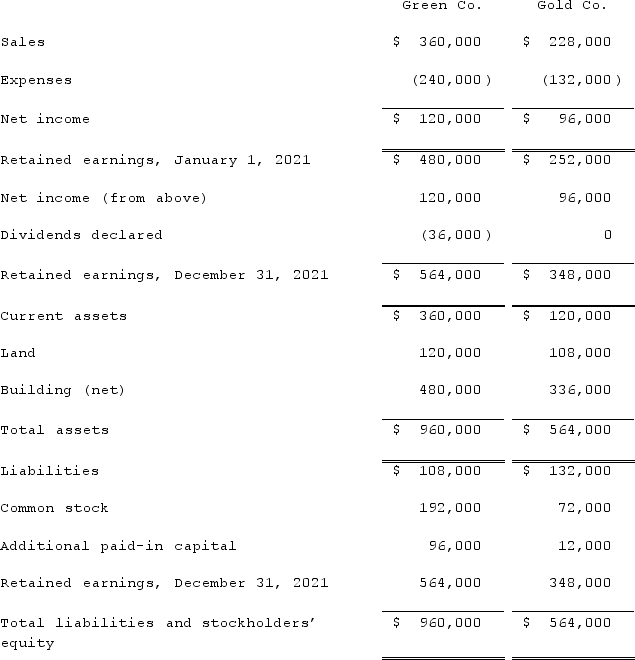

The following are preliminary financial statements for Green Co. and Gold Co. for the year ending December 31, 2021 prior to Green's acquisition of Gold.  On December 31, 2021 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold. Green's stock on that date has a fair value of $60 per share. Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000. Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required:Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021 after the acquisition transaction is completed.

On December 31, 2021 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold. Green's stock on that date has a fair value of $60 per share. Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000. Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required:Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021 after the acquisition transaction is completed.

Definitions:

Retained Earnings

Retained earnings represent the cumulative amount of net income earned by a company that is kept within the company for reinvestment in its operations or to pay debt, rather than being paid out as dividends to shareholders.

Paid-In Capital

The complete sum of money and various assets that investors have provided to a corporation in return for its shares.

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout, increasing the number of shares owned by each shareholder.

Authorized Shares

The maximum number of shares that a corporation is legally permitted to issue, as specified in its charter.

Q1: A _ is a price reduction offered

Q16: Scott Co. paid $2,800,000 to acquire all

Q19: Watkins, Inc. acquires all of the outstanding

Q36: Pell Company acquires 80% of Demers Company

Q45: What is the basic objective of all

Q51: Wilkins Inc. acquired 100% of the voting

Q71: Jager Inc. holds 30% of the outstanding

Q74: In a business combination where a subsidiary

Q90: Research shows that using humorous advertising is

Q130: A price tactic that requires the buyer