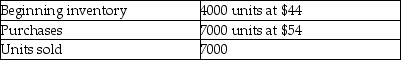

Using the following data, by how much would taxable income change if LIFO is used rather than FIFO?

Definitions:

Implied Warranty

A legal term for the assurance that a product is fit for its intended purpose, even if not explicitly stated at the time of sale.

Commercial Purposes

Activities or transactions conducted with the goal of generating profit or involving the buying and selling of goods and services.

Implied Warranties

Warranties that are not expressly stated but are assumed by law to exist in a sales contract to protect the buyer.

Common Law

A legal system grounded in established precedents and traditions, not on written statutes.

Q24: If ending inventory for a year is

Q44: When inventory is shipped from the seller

Q56: Accounts receivable are reported on the balance

Q57: The inventory cost under the average cost

Q67: The category "Other Receivables" on the balance

Q81: Outstanding checks are checks that have been

Q82: The use of the FIFO method generally

Q91: Which statement is FALSE?<br>A)LIFO is not allowed

Q98: The Internal Revenue Service allows companies to

Q117: Patents are amortized over a period of:<br>A)20