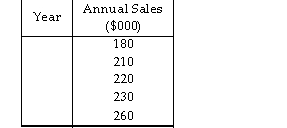

Mr. Grant is considering a capacity expansion for his store. The annual sales projected for the next five years follow. The current capacity is equivalent to $200,000 sales. Assume a 20 percent pretax profit margin.

If Grant expands his capacity to $225,000 now, what would be the increase in his pretax cash flows for each of the next five years?

Definitions:

Bond Certificate

A legal document that indicates the name of the issuer, the face value of the bonds, the contractual interest rate, and maturity date of the bonds.

Conversion Feature

An option in some financial instruments, such as bonds, that allows the holder to convert the instrument into other securities, typically shares of the issuing company, under specified conditions.

Common Stock

A type of equity security that represents ownership in a corporation, granting holders voting rights and a share in the company's profits via dividends.

Market Price

The current price at which an asset or service can be bought or sold in the open market.

Q16: What is the function of route planning?<br>A)

Q30: A firm's supply chain is sometimes called

Q36: Explain the three major supply chain processes

Q46: Relative to centralized buying, localized buying has

Q63: Historically, the average diameter of the

Q78: Deming argued that the vast majority of

Q87: In a manufacturing company, measuring capacity based

Q100: How are outsourcing and vertical integration related?

Q115: _ is the mix of equipment and

Q137: The most thorough approach to inspection is