Note: This is a Kaplan CPA Review Question

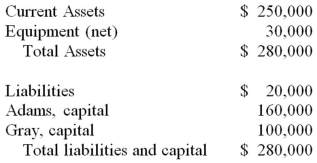

The condensed balance sheet of Adams & Gray, a partnership, at December 31, 20X1, follows:

On December 31, 20X1, the fair values of the assets and liabilities were appraised at $240,000 and $20,000, respectively, by an independent appraiser. On January 2, 20X2, the partnership was incorporated and 1,000 shares of $5 par value common stock were issued. Immediately after the incorporation, what amount should the new corporation report as additional paid-in capital?

Definitions:

Excise Tax

A tax applied to specific goods, services, or activities, often with the intention of reducing consumptions, such as taxes on tobacco or alcohol.

Tax Incidence

The study of who ultimately bears the economic burden of a tax, whether producers or consumers.

Inelastic Demand

A situation where the demand for a product does not significantly change with a change in its price.

Excise Tax

A tax levied on the sale of particular goods and services, such as alcohol, tobacco, and gasoline.

Q3: Winner Corporation acquired 80 percent of the

Q5: All assets and liabilities are transferred to

Q7: Which of the following best describes the

Q12: Denver Corporation owns 25 percent of the

Q19: Denver Corporation owns 25 percent of the

Q24: Granite Company issued $200,000 of 10 percent

Q28: All assets and liabilities are transferred to

Q31: Dundee Company issued $1,000,000 par value 10-year

Q59: Which of the following items should not

Q93: Golden Path, a labor union, had the