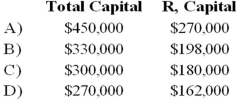

RD formed a partnership on February 10, 20X9. R contributed cash of $150,000, while D contributed inventory with a fair value of $120,000. Due to R's expertise in selling, D agreed that R should have 60 percent of the total capital of the partnership. R and D agreed to recognize goodwill. What is the total capital of the RD partnership and the capital balance of R after the goodwill is recognized?

Definitions:

International Monetary Fund

The International Monetary Fund is an international organization aimed at fostering global monetary cooperation, securing financial stability, and facilitating international trade.

Cross Rate

The exchange rate between two currencies, calculated based on their respective exchange rates with a third common currency.

Exchange Rates

The value of one currency expressed in terms of another currency.

Exchange Rate Fluctuations

Variations in the value of one currency relative to another, which can affect the profitability of international investments and trade.

Q11: In a private, not-for-profit hospital, which fund

Q18: Mortar Corporation acquired 80 percent of Granite

Q22: What amount should be reported as expenditures

Q28: Senior Corporation acquired 80 percent of Junior

Q28: Granite Company issued $200,000 of 10 percent

Q30: On January 1, 20X7, Pisa Company acquired

Q34: Briefly discuss the various types of governmental

Q40: On July 1, 20X8, Fair Logic Corporation

Q42: Note: This is a Kaplan CPA Review

Q42: A partner's tax basis in a partnership