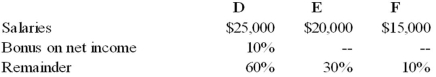

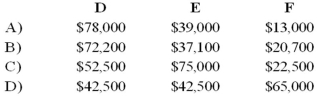

The DEF partnership reported net income of $130,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to D, E, and F?

How should partnership net income for 20X8 be allocated to D, E, and F?

Definitions:

Mental Experiences

Mental experiences encompass all subjective phenomena associated with thoughts, feelings, perceptions, and consciousness.

Observable Behaviors

Actions or reactions of an individual that are visible and can be noted or recorded.

Learning

The acquisition of knowledge or skills through experience, study, or teaching, leading to a relatively permanent change in behavior.

Alligators

Large, carnivorous reptiles primarily found in the United States and China, known for their armored bodies and powerful jaws.

Q7: What do the capital and small letters

Q10: On a partner's personal statement of financial

Q11: Which one of the following is an

Q18: Note: This is a Kaplan CPA Review

Q21: In the computation of a partner's Loss

Q22: Each of the following questions names an

Q46: Partners Dennis and Lilly have decided to

Q56: On a partner's personal statement of changes

Q58: Private Not-For-Profit (NFP) Entities.<br>Select from this list

Q94: Private Not-For-Profit (NFP) Entities.<br>Select from this list