Note: This is a Kaplan CPA Review Question

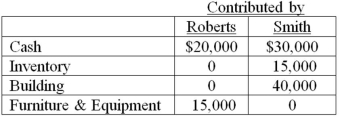

Roberts and Smith drafted a partnership agreement that lists the following assets contributed at the partnership's formation:

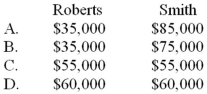

The building is subject to a mortgage of $10,000, which the partnership has assumed. The partnership agreement also specifies that profits and losses are to be distributed evenly. What amounts should be recorded as capital for Roberts and Smith at the formation of the partnership?

Definitions:

Unwanted Visual Effects

Visual artifacts or disturbances that degrade the quality or appearance of digital media or interfaces.

Digital Information

Data that is encoded digitally, enabling storage, processing, and transmission by electronic devices, contrasting with analog formats.

Recommendation Engine

A system that suggests products, services, or information to users based on analysis of data, typically employing algorithms for personalized experiences.

Raw Data

Information that has not been processed or analyzed, typically coming directly from a source without any cleaning or modification.

Q7: Creditors may file which type of petition

Q15: On January 1, 20X7, Gild Company acquired

Q18: Mortar Corporation acquired 80 percent of Granite

Q19: Shue, a partner in the Financial Brokers

Q22: Golden Path, a labor union, had the

Q35: In the RST partnership, Ron's capital is

Q45: Note: This is a Kaplan CPA Review

Q47: Which of the following best describes a

Q48: The transactions described in the following questions

Q50: A debt service fund for the City