Note: This is a Kaplan CPA Review Question

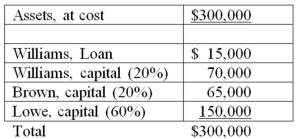

On June 30, the balance sheet for the partnership of Williams, Brown and Lowe, together with their respective profit and loss ratios, was as follows:

Williams has decided to retire from the partnership and by mutual agreement the assets are to be adjusted to their fair value of $360,000 at June 30. It was agreed that the partnership would pay Williams $102,000 cash for his partnership interest exclusive of his loan which is to be repaid in full. No goodwill is to be recorded in this transaction. After William's retirement, and before the loan is repaid, what are the capital account balances of Brown and Lowe, respectively?

Definitions:

Endocrine Glands

Glands that secrete hormones directly into the bloodstream to regulate various bodily functions.

TSH

Thyroid Stimulating Hormone, a pituitary hormone that regulates the production of hormones by the thyroid gland.

Anterior Pituitary Gland

A major gland of the endocrine system located at the base of the brain, responsible for producing and releasing hormones that regulate various bodily functions.

Thyroid Hormones

Chemical substances produced by the thyroid gland, such as thyroxine (T4) and triiodothyronine (T3), which regulate metabolism, energy generation, and growth and development.

Q4: Note: This is a Kaplan CPA Review

Q7: In 20X9, a private not-for-profit hospital received

Q20: Michigan-based Leo Corporation acquired 100 percent of

Q21: In accordance with ASC 958, contributions of

Q22: Partners Dennis and Lilly have decided to

Q41: In cases of operations located in highly

Q45: A limited liability company (LLC):<br>I. is governed

Q56: On a partner's personal statement of changes

Q68: A donor agrees to contribute $5,000 per

Q116: A private, not-for-profit hospital uses a fund