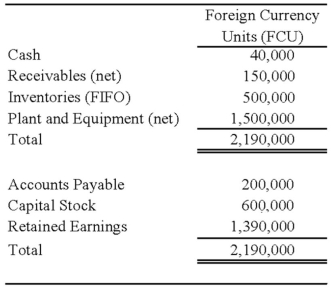

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

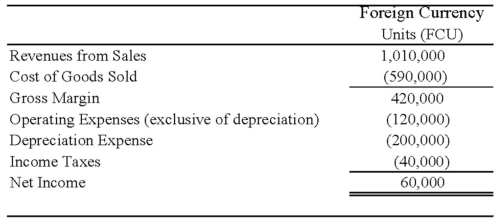

Perth's income statement for 20X8 is as follows:

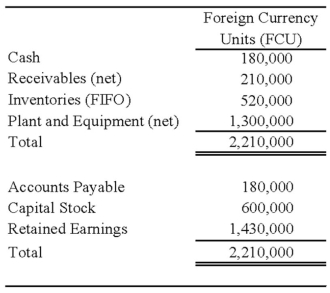

The balance sheet of Perth at December 31, 20X8, is as follows:

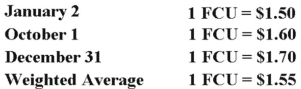

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming Perth's local currency is the functional currency, what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2, 20X8. Round your answer to the nearest dollar.

Definitions:

Activity Rate

A measure used in activity-based costing to assign costs to activities based on their use of resources.

Batch Setup

The process of preparing equipment and machinery for a specific batch of production, including configuration and adjustments.

Activity Cost Pools

A method in cost accounting where costs are accumulated according to activities performed, facilitating more accurate product or service costing.

Q5: GASB 34 specifies two criteria for determining

Q23: Note: This is a Kaplan CPA Review

Q27: Which of the following characteristics best describes

Q29: On December 1, 20X8, Secure Company bought

Q38: On January 1, 20X9, A Company acquired

Q46: A system of domination with men exercising

Q48: Wakefield Company uses a perpetual inventory system.

Q50: Spiralling crude oil prices prompted AMAR Company

Q50: FASB has specified a "75% percent consolidated

Q68: A donor agrees to contribute $5,000 per