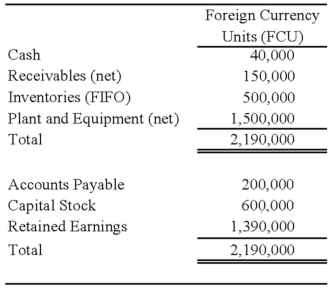

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

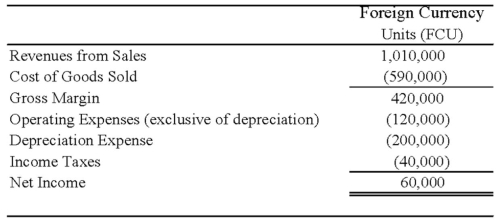

Perth's income statement for 20X8 is as follows:

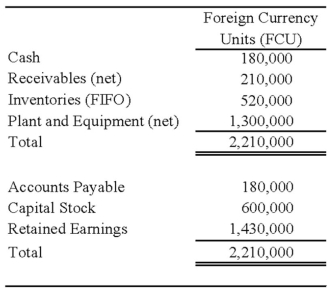

The balance sheet of Perth at December 31, 20X8, is as follows:

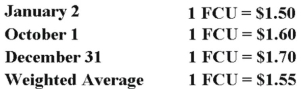

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming Perth's local currency is the functional currency, what is the amount of translation adjustment that appears on Johnson's consolidated financial statements at December 31, 20X8?

Definitions:

Q12: Economic globalization is<br>A) a place in Europe

Q17: Which sections of the cash flow statement

Q26: Note: This is a Kaplan CPA Review

Q28: All assets and liabilities are transferred to

Q45: The trial balance of WM Partnership is

Q51: Which of the following observations concerning encumbrances

Q67: When a capital projects fund transfers a

Q72: Laura was an anthropologist who was studying

Q82: _is regarded as the ʺfather of sociology.ʺ

Q117: The transactions described in the following questions