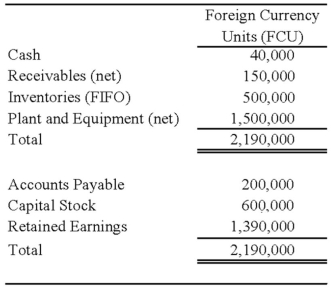

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

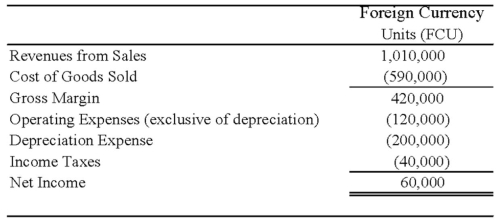

Perth's income statement for 20X8 is as follows:

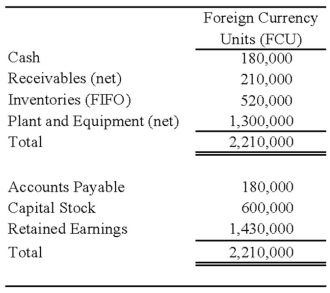

The balance sheet of Perth at December 31, 20X8, is as follows:

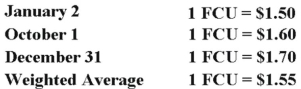

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming the U.S. dollar is the functional currency, what is the amount of Perth's cost of goods sold remeasured in U.S. dollars?

Definitions:

Budgeted Sales

Projected sales figures used for planning and forecasting in business operations.

Credit Sales

Credit sales are transactions where goods or services are provided to a customer with the agreement that payment will be made at a later date.

Finished Goods Inventory

Inventory of finished goods available for sale to consumers.

Required Production

The quantity of goods that must be produced during a particular time period to meet customer demand.

Q1: On January 1, 20X7, Gild Company acquired

Q15: Which of the following statements is true

Q27: Each of the following questions names an

Q28: The partnership of X and Y shares

Q31: Under the temporal method, which of the

Q37: The British subsidiary of a U.S. company

Q47: On January 1, 20X7, Servant Company purchased

Q65: On January 1, 20X8, Transport Corporation acquired

Q86: Local Services, a voluntary health and welfare

Q87: Overall, the textʹs author argues that popular