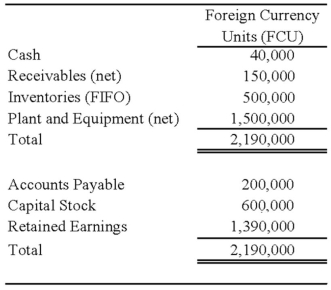

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

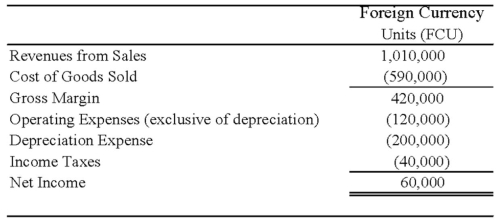

Perth's income statement for 20X8 is as follows:

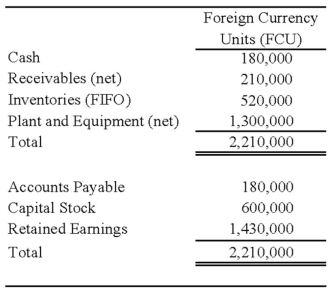

The balance sheet of Perth at December 31, 20X8, is as follows:

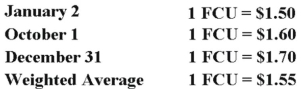

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming Perth's local currency is the functional currency, what is the balance in Johnson's investment in foreign subsidiary account at December 31, 2008?

Definitions:

Frequent Purchase

The repeated buying of goods or services on a regular basis, often indicative of customer loyalty or habitual behavior.

Personal Use

Utilization of products or services for individual needs rather than for business or commercial purposes.

Antecedent State

Refers to the psychological and physiological conditions of consumers that influence their behavior before encountering a marketing stimulus.

External Search

The process consumers undergo seeking information from sources outside themselves, such as reviews or expert opinions, before making a purchase decision.

Q9: Gotham City acquires $25,000 of inventory on

Q11: Fixed assets and investments are reported in

Q11: Which regulation created the Securities and Exchange

Q21: An enterprise fund of Grist was billed

Q41: Suppose the direct foreign exchange rates in

Q45: The trial balance of WM Partnership is

Q55: A debt service fund of Clifton received

Q63: The transactions listed in the following questions

Q64: Sociologists study human behavior through books, magazines,

Q65: Local Services, a voluntary health and welfare