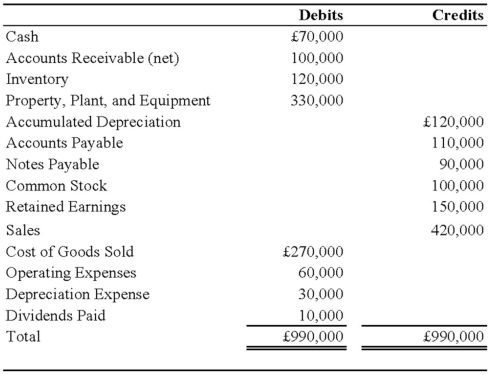

On January 1, 2008, Pace Company acquired all of the outstanding stock of Spin PLC, a British Company, for $350,000. Spin's net assets on the date of acquisition were 250,000 pounds (£). On January 1, 2008, the book and fair values of the Spin's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and trademarks. The fair value of Spin's property, plant, and equipment exceeded its book value by $25,000. The remaining useful life of Spin's equipment at January 1, 2008, was 10 years. The remainder of the differential was attributable to a trademark having an estimated useful life of 5 years. Spin's trial balance on December 31, 2008, in pounds, follows:

Additional Information

1. Spin uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 2007, and ending inventory was acquired on December 26, 2008. Purchases of £300,000 were made evenly throughout 2008.

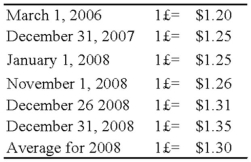

2. Spin acquired all of its property, plant, and equipment on March 1, 2006, and uses straight-line depreciation.

3. Spin's sales were made evenly throughout 2008, and its operating expenses were incurred evenly throughout 2008.

4. The dividends were declared and paid on November 1, 2008.

5. Pace's income from its own operations was $150,000 for 2008, and its total stockholders' equity on January 1, 2008, was $1,000,000. Pace declared $50,000 of dividends during 2008.

6. Exchange rates were as follows:

Assume the U.S. dollar is the functional currency, not the pound.

Required:

1) Prepare a schedule remeasuring the trial balance from British pound into U.S. dollars.

2) Assume that Pace uses the fully adjusted equity method. Record all journal entries that relate to its investment in the British subsidiary during 2008. Provide the necessary documentation and support for the amounts in the journal entries.

3) Prepare a schedule that determines Pace's consolidated net income for 2008.

Definitions:

Direct Materials

Raw materials that are directly attributable and integral to the manufacturing of a product.

Ceramic Tile

A durable, hard surface tile made from clay that has been fired at high temperatures, used for covering floors, walls, or other surfaces.

Administrative Expense

Expenses related to the general operation of a business, including executive salaries, legal and professional fees, and office supplies.

Variable Cost

Costs that fluctuate in direct proportion to changes in levels of output or activity within a business.

Q4: A special revenue fund should be used

Q13: Winner Corporation acquired 80 percent of the

Q18: Samuel Corporation foresees a downturn in its

Q35: All of the following statements are borne

Q42: Emile Durkheim is associated with the_ perspective.<br>A)

Q45: Which of the following funds report fixed

Q61: Freudʹs term for the part of personality

Q74: Following are four independent transactions or events

Q93: Golden Path, a labor union, had the

Q117: The transactions described in the following questions