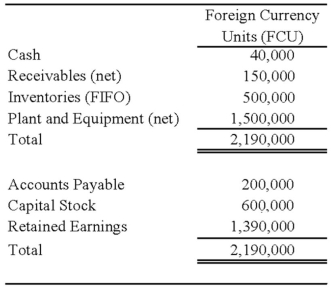

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

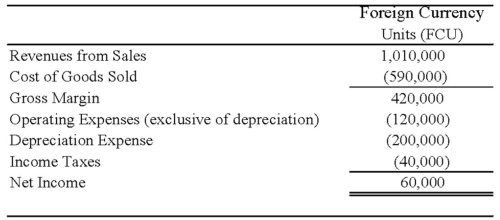

Perth's income statement for 20X8 is as follows:

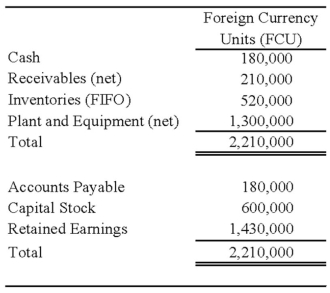

The balance sheet of Perth at December 31, 20X8, is as follows:

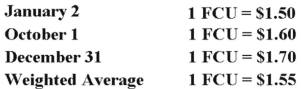

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming the U.S. dollar is the functional currency, what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2, 20X8?

Definitions:

Q11: Fixed assets and investments are reported in

Q15: Mortar Corporation acquired 80 percent of Granite

Q24: When a new partner is admitted into

Q25: The balance in Newsprint Corp.'s foreign exchange

Q26: Define sociology and how it differs from

Q29: In order to avoid inequalities in the

Q39: Which of the following financial statements would

Q46: The attitude that oneʹs culture is superior

Q76: Today, the world has become a community

Q108: Good Faith Hospital, operated by a religious