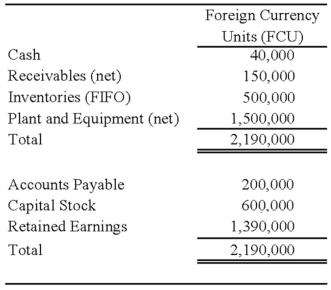

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

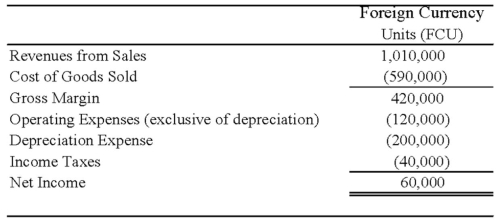

Perth's income statement for 20X8 is as follows:

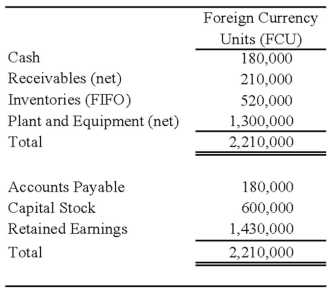

The balance sheet of Perth at December 31, 20X8, is as follows:

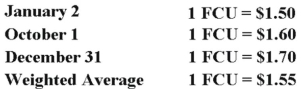

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming the U.S. dollar is the functional currency, what is Johnson's remeasurement gain (loss) for 20X8? (Assume the ending inventory was acquired on December 31, 20X8.)

Definitions:

Product Mix

The total range of products offered by a company, including variations of products based on size, color, and other attributes.

Closely Related

Items or concepts that are very similar or connected in a direct or immediate way.

Category Management

A retail and supply chain management strategy where products are managed by category as a single strategic business unit to improve performance.

Outsourcing

The practice of hiring third parties to perform services or create goods that were traditionally performed in-house by the company's own employees and staff.

Q4: A special revenue fund should be used

Q6: Levin company entered into a forward contract

Q22: Golden Path, a labor union, had the

Q28: Catalyst Corporation acquired 90 percent of Trigger

Q30: ASC 280, Disclosure about Segments of an

Q43: Each of the following questions names an

Q45: Which of the following is defined as

Q46: When the old partners receive a bonus

Q49: Dover Company owns 90% of the capital

Q77: Sally was very pleased when she receive