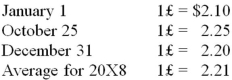

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1, 20X8, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 20X8, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 20X8, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25, 20X8. Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds. Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount. Exchange rates at various dates during 20X8 follow:  Based on the preceding information, what amount should Leo record as "income from subsidiary" based on the British subsidiary's reported net income?

Based on the preceding information, what amount should Leo record as "income from subsidiary" based on the British subsidiary's reported net income?

Definitions:

Domestic Abuse

A pattern of behavior in any relationship utilized to gain or maintain power and control over an intimate partner.

Nagging

Persistently annoying or finding fault with someone to do something, often perceived as repetitive and bothersome communication.

Career Decision

A process in which individuals choose a profession or path based on their interests, values, and the market demand.

Therapeutically

Pertains to the use of remedies or therapies to treat disease or relieve pain in a manner that heals or benefits.

Q12: If a company changes the method it

Q32: On December 1, 20X8, Hedge Company entered

Q35: The transactions described in the following questions

Q40: All of the following are benefits the

Q49: Is the U. S. losing its world

Q51: Micron Corporation owns 75 percent of the

Q55: Note: This is a Kaplan CPA Review

Q57: Note: This is a Kaplan CPA Review

Q61: On December 1, 20X8, Hedge Company entered

Q76: Today, the world has become a community