Note: This is a Kaplan CPA Review Question

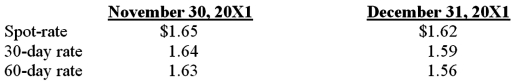

Hunt Co. purchased merchandise for 300,000 British pounds from a vendor in London on November 30, 20X1. Payment in British pounds was due on January 30, 20X2. The exchange rates to purchase one pound were as follows:

In its December 31, Year One, income statement, what amount should Hunt report as foreign exchange gain?

Definitions:

Acid-Test Ratio

A liquidity ratio that measures a company's ability to pay off its current liabilities with quick assets (cash, marketable securities, and receivables).

Accounts Receivable

Money owed to a company by its customers for products or services that have been delivered but not yet paid for.

Inventory

The total amount of goods and materials held by a company for the purpose of resale or production.

Current Ratio

A financial ratio that gauges a firm's capacity to meet its short-term debts or obligations due within the next year.

Q1: When a new partner is admitted into

Q5: Cutler Company owns 80 percent of the

Q10: ABC Corporation purchased land on January 1,

Q13: Sky Corporation owns 75 percent of Earth

Q20: Boycott Company holds 75 percent ownership of

Q20: The CRT partnership has decided to terminate

Q25: Fred Corporation owns 75 percent of Winner

Q25: Which system helps the SEC accomplish its

Q47: On January 1, 20X7, Pisa Company acquired

Q61: Frahm Company incurred a first quarter operating