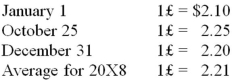

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1, 20X8, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 20X8, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 20X8, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25, 20X8. Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds. Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount. Exchange rates at various dates during 20X8 follow:  Based on the preceding information, on Leo's consolidated balance sheet at December 31, 20X8, what amount should be reported for the goodwill acquired on January 1, 20X8?

Based on the preceding information, on Leo's consolidated balance sheet at December 31, 20X8, what amount should be reported for the goodwill acquired on January 1, 20X8?

Definitions:

Psychopathology

The scientific study of psychological disorders and abnormalities in behavior, emotions, and thought processes.

Anxious Adults

Individuals who exhibit anxiety in relationships, often stemming from insecure attachments developed in early life.

Authoritative Parents

A parenting style characterized by high expectations of maturity and high responsiveness to children's needs.

Socially Adjusted

The ability of an individual to conform to societal norms and expectations, often reflecting a level of personal wellbeing and societal integration.

Q3: A research method that involves asking questions

Q7: Vision Corporation acquired 75 percent of the

Q14: Light Corporation owns 80 percent of Sound

Q20: Note: This is a Kaplan CPA Review

Q26: Note: This is a Kaplan CPA Review

Q40: Critics of the feminist theory criticize the

Q50: Reporting requirements of other not-for-profit entities (ONPOs)

Q53: U.S. sociology was reshaped during the 1960s

Q88: The transactions described in the following questions

Q97: Private Not-For-Profit (NFP) Entities.<br>Select from this list