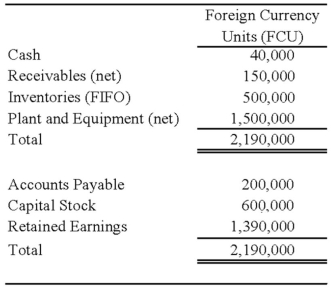

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

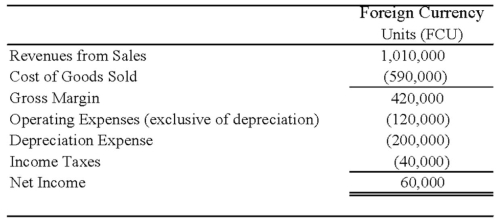

Perth's income statement for 20X8 is as follows:

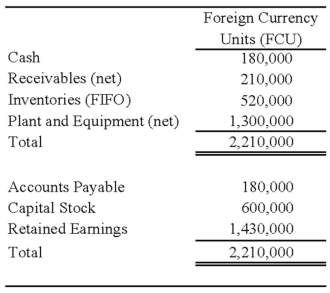

The balance sheet of Perth at December 31, 20X8, is as follows:

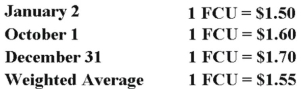

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming the U.S. dollar is the functional currency, what is the balance in Johnson's investment in foreign subsidiary account at December 31, 2008?

Definitions:

Practice Gaps

Discrepancies between health care practices as they are and as they should be according to evidence-based standards, indicating areas for improvement.

Bridging Programs

Educational or training programs designed to help individuals bridge gaps in their knowledge or skills, often targeting specific professions or academic fields.

Colleges and University

Institutions of higher education offering undergraduate and postgraduate degrees.

Evidence-Informed Practice

The melding of professional clinical skills, preferences of the patient, and the finest research findings in the decision-making procedure for patient treatment.

Q6: Perfect Corporation acquired 70 percent of Trevor

Q8: Both the FCPA (Foreign Corrupt Practices Act

Q23: Bill, Page, Larry, and Scott have decided

Q25: Cinema Company acquired 70 percent of Movie

Q26: Secondary groups are more commonly found in<br>A)

Q35: Which of the following acts requires that

Q49: Is the U. S. losing its world

Q52: Note: This is a Kaplan CPA Review

Q81: Private Not-For-Profit (NFP) Entities.<br>Select from this list

Q86: In the past, when elderly Inuit committed