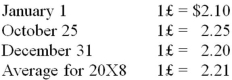

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1, 20X8, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 20X8, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 20X8, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25, 20X8. Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds. Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount. Exchange rates at various dates during 20X8 follow:  Based on the preceding information, in the stockholders' equity section of Leo's consolidated balance sheet at December 31, 20X8, Leo should report the translation adjustment as a component of other comprehensive income of:

Based on the preceding information, in the stockholders' equity section of Leo's consolidated balance sheet at December 31, 20X8, Leo should report the translation adjustment as a component of other comprehensive income of:

Definitions:

Genetic Information

Data about an individual's genotypes, genetic tests, and family medical history, often used in healthcare to assess disease risk.

Discrimination

Unjust or prejudicial treatment of different categories of people, especially on the grounds of race, age, sex, or disability.

Group Health Plan

A health insurance plan offered by employers, organizations, or entities to its members, providing medical care benefits to a group of people.

Respondeat Superior

Let the master answer.

Q5: On January 1, 2008, Orion Company acquired

Q5: Culture is<br>A) a sophisticated knowledge of opera

Q14: Light Corporation owns 80 percent of Sound

Q17: Participation in war often promotes social solidarity

Q33: Culver owns 80 percent of the common

Q51: Briefly explain the following terms associated with

Q54: When Disney and Charles decided to incorporate

Q60: The general fund of Sun City was

Q71: A donor agrees to contribute $5,000 per

Q72: By using each of the three sociological