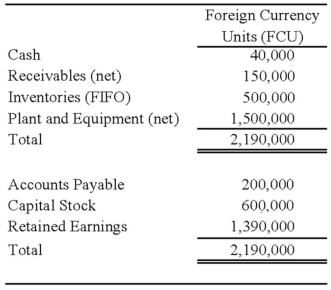

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

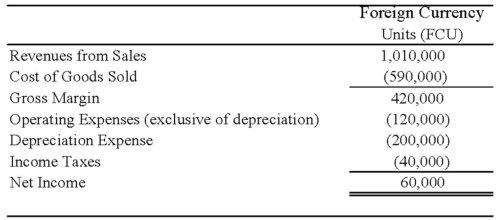

Perth's income statement for 20X8 is as follows:

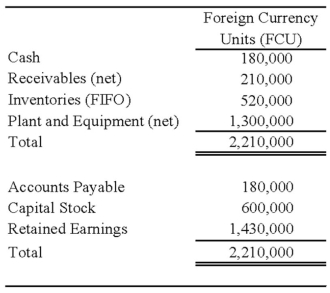

The balance sheet of Perth at December 31, 20X8, is as follows:

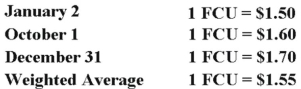

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

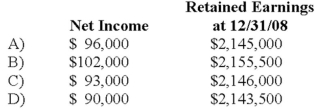

Refer to the above information. Assuming the local currency of the country in which Perth Company is located is the functional currency, what are the translated amounts for the items below in U.S. dollars?

Definitions:

High-level Dependence

A situation where an individual, system, or process relies significantly on another for support, resources, or functioning.

Intellectual Capital

The collective knowledge, experience, and skills of an organization's employees that gives it a competitive advantage.

Knowledge Work

Work that tends to feature non-routine problem solving, accomplished through intellectual labor and information analysis.

Asset

Resources owned by individuals or entities, providing current or future economic benefits.

Q1: The restricted funds of a not-for-profit hospital

Q10: Granite Company issued $200,000 of 10 percent

Q28: The transactions listed in the following questions

Q39: Elan, a U.S. corporation, completed the December

Q46: ASC 280 uses a(n) _ approach to

Q54: Note: This is a Kaplan CPA Review

Q69: The transactions listed in the following questions

Q74: Gotham City acquires $25,000 of inventory on

Q89: A major contributor to the establishment of

Q93: Golden Path, a labor union, had the