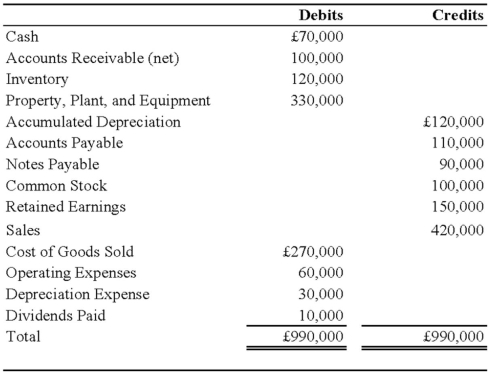

On January 1, 2008, Pace Company acquired all of the outstanding stock of Spin PLC, a British Company, for $350,000. Spin's net assets on the date of acquisition were 250,000 pounds (£). On January 1, 2008, the book and fair values of the Spin's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and trademarks. The fair value of Spin's property, plant, and equipment exceeded its book value by $25,000. The remaining useful life of Spin's equipment at January 1, 2008, was 10 years. The remainder of the differential was attributable to a trademark having an estimated useful life of 5 years. Spin's trial balance on December 31, 2008, in pounds, follows:

Additional Information

1. Spin uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 2007, and ending inventory was acquired on December 26, 2008. Purchases of £300,000 were made evenly throughout 2008.

2. Spin acquired all of its property, plant, and equipment on March 1, 2006, and uses straight-line depreciation.

3. Spin's sales were made evenly throughout 2008, and its operating expenses were incurred evenly throughout 2008.

4. The dividends were declared and paid on November 1, 2008.

5. Pace's income from its own operations was $150,000 for 2008, and its total stockholders' equity on January 1, 2008, was $1,000,000. Pace declared $50,000 of dividends during 2008.

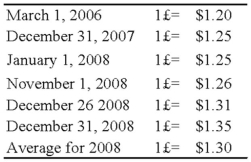

6. Exchange rates were as follows:

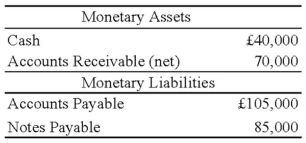

Assume the U.S. dollar is the functional currency, not the pound. Prepare a schedule providing a proof of the remeasurement gain or loss. Assume that the British subsidiary had the following monetary assets and liabilities at January 1, 2008:

Definitions:

Exchange Rates

The equivalent worth of one currency in another during exchange.

Exchange Gain/Loss

The gain or loss resulting from the fluctuation in exchange rates affecting the value of transactions in foreign currencies.

Acquisition Differential

The difference between the purchase price of a company and the fair market value of its identifiable net assets.

Exchange Rates

The rate for transforming one currency into another.

Q2: A set of general assumptions about the

Q4: On December 1, 20X8, Winston Corporation acquired

Q14: Information concerning the unexpected resignation of one

Q15: Note: This is a Kaplan CPA Review

Q35: Hunter Corporation holds 80 percent of the

Q36: When a new partner is admitted into

Q47: Arlington has a debt service fund which

Q56: Spiralling crude oil prices prompted AMAR Company

Q71: The first sociologist to use formal scientific

Q74: A citizen of York purchased a truck