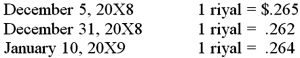

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) , to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:  Based on the preceding information, what was the overall foreign currency gain or loss on the accounts payable transaction?

Based on the preceding information, what was the overall foreign currency gain or loss on the accounts payable transaction?

Definitions:

Loftus

Elizabeth F. Loftus, an influential cognitive psychologist, known for her extensive research on the malleability of human memory.

Influential Researcher

A scientist or academic who has had a significant impact in their field, contributing valuable knowledge or groundbreaking theories.

Cultural Influences

The impact that culture, including values, beliefs, norms, and practices, has on the behavior, perceptions, and decision-making of individuals.

Tribal Peoples

Indigenous groups that maintain traditional lifestyles, cultures, and social structures within their communities.

Q7: Note: This is a Kaplan CPA Review

Q10: What does an underwriter typically require from

Q31: Unlike Herrnstein and Murray, most social scientists

Q34: A method of observation in which the

Q36: Heavy Company sold metal scrap to a

Q36: Which accounts described below would have non-zero

Q37: On December 1, 20X8, Denizen Corporation entered

Q41: Suppose the direct foreign exchange rates in

Q47: Which of the following best describes a

Q53: Samuel Huntington suggested that cultural differences are