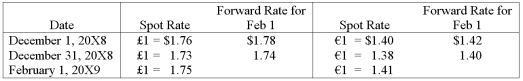

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information, what is the overall effect of speculation on 20X8 net income?

Definitions:

Amount

The total sum or quantity of something, often specified in terms of money or units.

Interest

The cost of borrowing money, usually expressed as a percentage of the amount borrowed.

Tax Rate

The specific ratio of income that must be given to the government as tax by both people and companies.

Budgeting Process

A systematic approach where businesses estimate their future income, expenditures, and capital needs to achieve their financial goals.

Q1: On January 1, 20X7, Servant Company purchased

Q13: The general fund of Athens ordered computer

Q14: Which of the following accounts is not

Q16: On March 1, 20X8, Wilson Corporation sold

Q25: Which of the following statements is(are) correct?<br>I.

Q32: Each of the following questions names an

Q38: On December 1, 20X8, Winston Corporation acquired

Q48: On July 25, 20X8, the city of

Q54: Newport Village was recently incorporated and began

Q62: Even though sociologists and feminists criticize Freudʹs