On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

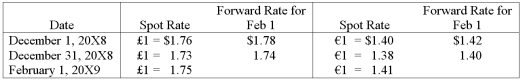

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information, what is the net gain or loss on the euro speculative contract?

Definitions:

Pepperoni Mini Calzones

A small, folded pizza-like dish filled with pepperoni and cheese, typically baked and served as a snack or appetizer.

Easy-to-Prepare

Referring to products that require minimal time, effort, or cooking skills to make ready for consumption.

Point-Of-Purchase

The location or moment at which a transaction occurs, often used in marketing to refer to strategic placements of products or promotions.

Store Aisle

A passageway between shelves and stands in a store, designed to facilitate the movement of customers and the display of products.

Q9: The personal financial statements of a partner

Q30: A personal statement of financial condition dated

Q39: During the third quarter of 20X8, Pride

Q45: Which of the following is defined as

Q46: GASB 34 established four types of interfund

Q47: On January 1, 20X7, Servant Company purchased

Q49: Asian American parents socialize their children for

Q51: The belief that cultures can only be

Q67: In a study of three significantly different

Q74: A citizen of York purchased a truck