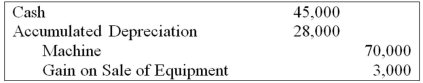

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:  Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information, consolidated net income for 20X9 will be:

Definitions:

Enforce

To enforce adherence to or fulfillment of a regulation, statute, or duty.

Irrevocable Will

is a will that cannot be revoked or altered once it has been finalized, ensuring that the wishes of the deceased are carried out as specified.

Trust Instrument

A legal document that sets up a trust agreement, specifying how the trust assets are to be managed and distributed.

Trustee

An individual or organization that holds or manages and invests property or assets for the benefit of a third party.

Q17: Suppose the direct foreign exchange rates in

Q18: In the AD partnership, Allen's capital is

Q24: Note: This is a Kaplan CPA Review

Q26: According to contemporary conflict theorists such as

Q30: Note: This is a Kaplan CPA Review

Q39: If a child learns to associate emotions

Q48: Each of the following questions names an

Q71: If a collection of people share some

Q78: Alice and Jake are new in town

Q86: _is the study or practice of humor.