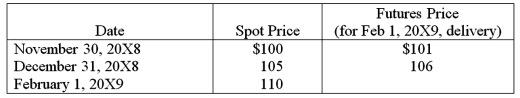

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

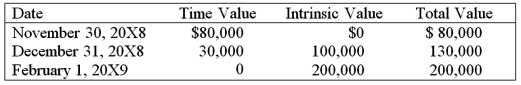

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information, in the entry to record the increase in the intrinsic value of the options on December 31, 20X8,

Definitions:

Sternal Region

The sternal region refers to the area of the body located at the middle of the chest, where the sternum or breastbone is situated.

Breastbone

Also known as the sternum, it is a long flat bone located in the central part of the chest, connecting the rib bones.

Lumbar Region

The lower part of the spine between the diaphragm and the sacrum, consisting of five vertebrae.

Lower Back

The area of the back extending from the bottom of the rib cage to the top of the pelvic region, often a common site for pain or discomfort.

Q1: Socialization refers to<br>A) the fact that humans

Q11: Note: This is a Kaplan CPA Review

Q16: The City of Fargo issued general obligation

Q24: On July 1, 20X8, Fair Logic Corporation

Q34: On January 1, 20X7, Servant Company purchased

Q38: The general fund of the City of

Q43: The Town of Pasco has no supplies

Q45: A limited liability company (LLC):<br>I. is governed

Q51: The management approach to the definition of

Q62: _is a design for living that includes