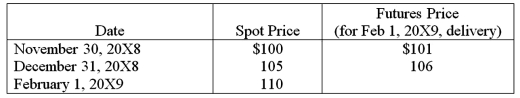

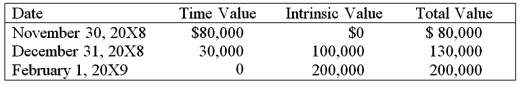

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information, the entries made on April 1, 20X9 will include:

Definitions:

Leadership Making

The process of developing and enhancing leadership qualities within an organization through strategies like coaching, mentoring, and training.

Acquaintance Phase

The initial stage of a relationship or process where parties get to know each other.

Leadership Making

The process of developing leadership qualities and capabilities within individuals or organizations.

Empowerment

The process of giving individuals or groups the power and authority to make decisions and act independently.

Q7: Locus Corporation acquired 80 percent ownership of

Q12: On March 1, 20X9, the ABC partnership

Q14: Lemon Corporation acquired 80 percent of Bricks

Q24: For which of the following funds are

Q29: All of the following are differences between

Q32: The partnership of Rachel, Adams, and Nixon

Q42: On December 1, 20X8, Merry Corporation acquired

Q49: Winner Corporation acquired 80 percent of the

Q60: John received a work promotion that will

Q65: Viewed from the conflict perspective, socialization can