Note: This is a Kaplan CPA Review Question

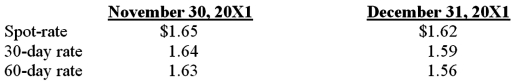

Hunt Co. purchased merchandise for 300,000 British pounds from a vendor in London on November 30, 20X1. Payment in British pounds was due on January 30, 20X2. The exchange rates to purchase one pound were as follows:

In its December 31, Year One, income statement, what amount should Hunt report as foreign exchange gain?

Definitions:

Armature

The rotating coil or core of a generator or motor on which the winding is placed and electrical current is induced.

Driveshaft

A mechanical component for transmitting torque and rotation, usually used in vehicles to connect other components of the drivetrain that cannot be directly connected.

Pole Pieces

Components in an electric motor or generator that enhance the magnetic field produced by the winding.

Permanent Magnet Motors

Electric motors that utilize permanent magnets in the rotor to create a constant magnetic field, improving efficiency and reducing energy consumption.

Q1: Proxy statements are:<br>A) filed by an entity

Q3: PeopleMag sells a plot of land for

Q15: An analysis of Abbey Company's operating segments

Q16: In the JAW partnership, Jane's capital is

Q40: On a partner's personal statement of financial

Q46: Partners Dennis and Lilly have decided to

Q46: Which division of the SEC develops and

Q63: Ponca City issued general obligation bonds to

Q72: Laura was an anthropologist who was studying

Q87: Using the work of Michael Schwartz 2005)