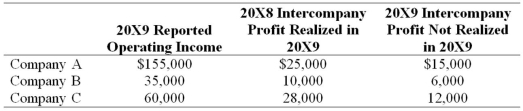

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock. All acquisitions were made at book value. The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies. The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000. Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X9 is as follows:  Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Based on the information provided, what amount of consolidated net income will be reported for the year 20X9?

Definitions:

Affinity Method

A technique used in project management and brainstorming that organizes a large amount of data into groups based on their natural relationships.

Collaborative Economic Bargaining

The process where employers and employees negotiate working conditions and terms of employment in a cooperative and mutually beneficial manner.

Costing Methodology

The process or system used to determine the expenses associated with producing a product or providing a service, which can influence pricing, budgeting, and financial analysis.

Modified Integrative Bargaining

A negotiation strategy that seeks a win-win outcome but with adjustments to traditional methods to accommodate specific needs or circumstances.

Q3: Which of the following observations is true

Q13: Which of the following is NOT a

Q35: Trimester Corporation's revenue for the year ended

Q48: Roberta is the manager of a bank

Q49: Emile Durkheimʹs classic study of suicide makes

Q50: Spiralling crude oil prices prompted AMAR Company

Q55: _morality was Kohlbergʹs term for the practice

Q57: The general fund of Battle Creek budgeted

Q64: On January 1, 2008, Pace Company acquired

Q78: Intelligence is either inherited or learned.