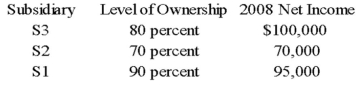

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:  Parent reported income from its separate operations of $200,000 for 20X8.

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information, what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8?

Definitions:

Role Play

An educational or therapeutic technique in which individuals act out roles in specific scenarios to learn about themselves, improve skills, or gain understanding of others.

Comprehensive Exam

An extensive examination that covers a wide range of material within a specific field of study, often a requirement for graduate-level programs.

Distorted View

An inaccurate or twisted perception of reality, often influenced by biases or misconceptions.

Q4: Which of the following is true about

Q5: Note: This is a Kaplan CPA Review

Q10: What does an underwriter typically require from

Q15: Social exchanges are usually governed by<br>A) laws

Q24: When a new partner is admitted into

Q35: On January 1, 20X9, Light Corporation sold

Q40: Mortar Corporation acquired 80 percent of Granite

Q44: Note: This is a Kaplan CPA Review

Q57: Mercury Company is a subsidiary of Neptune

Q88: Hank tends to treat others as enemies.