-If the government puts a $2 excise tax on a product and as a result,price rises by $0.75,which of the following statements is correct?

Definitions:

Cost of Goods Sold

Direct expenditures involved in the making of a company's sold products, which includes labor and material costs.

Freight Out

The cost of transporting goods from a seller's premises to the buyer's location, typically recorded as a selling expense by the seller.

Transportation to Consignees

The costs incurred to transport goods to consignees, who will sell the goods on behalf of the shipping party.

Cost Recovery Method

An accounting technique used to defer the recognition of income until the cash received from a transaction exceeds the costs associated with it.

Q15: Refer to the information above to answer

Q17: The price elasticity of demand for keyboards

Q25: What term is used to describe quantities

Q35: Refer to the graph above to answer

Q52: State whether each of the following is

Q69: Refer to the information above to answer

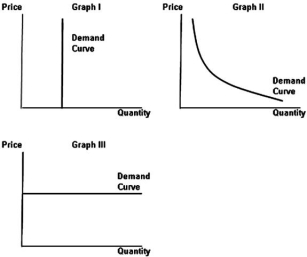

Q111: Refer to the graph above to answer

Q172: What causes marginal cost to increase?<br>A) The

Q177: If a product has many substitutes, which

Q185: What is the effect on product A