Alpha Ltd. is a Canadian-controlled private corporation operating a small

land-development business. In June 20X2, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial

information for the 20X2 taxation year is outlined below:

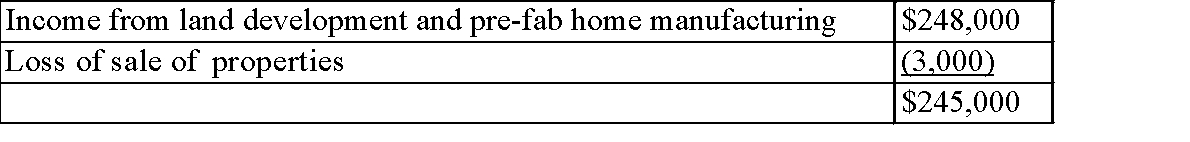

Alpha's profit before income taxes for the year ended November 30, 20X2, was

$245,000, as follows:

The loss on sale of property results from two transactions. On October 1, 20X2,

The loss on sale of property results from two transactions. On October 1, 20X2,

Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The

shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained

under a lease arrangement.

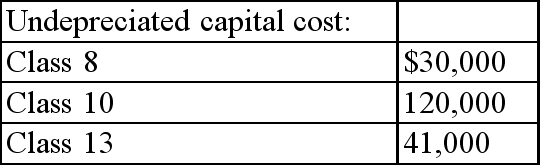

The 20X1 corporate tax return shows the following UCC balances:

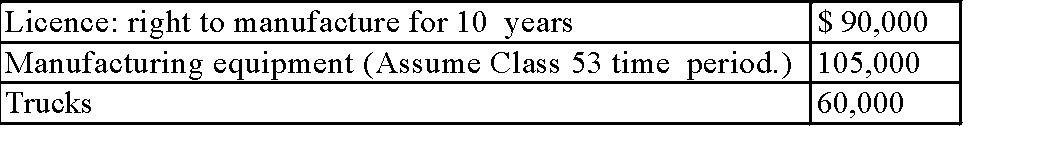

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20X2. At that

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20X2. At that

time, it acquired the following:

Accounting amortization in 20X2 amounted to $60,000.

Accounting amortization in 20X2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals or housing contractors. In 20X2, it sold part of its

undeveloped land inventory to another developer for $400,000. The sale realized a profit of $80,000, which is included in the land-development income above.

The proceeds consisted of $40,000 in cash, with the balance payable in five annual installments beginning in 20X3.

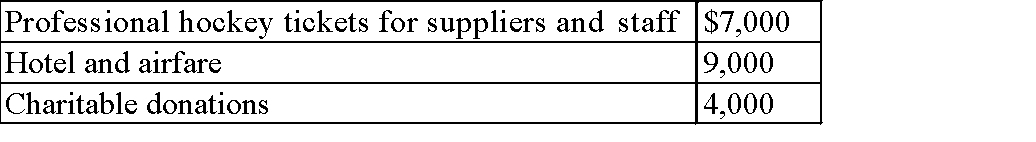

Travel and entertainment expense includes the following:

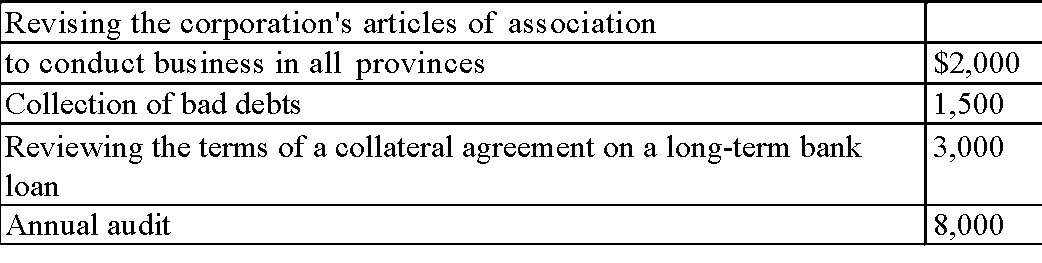

Legal and accounting expense includes the following:

Legal and accounting expense includes the following:

Required:

Required:

Calculate Alpha's net income for tax purposes for the 20X2 taxation year. (Assume a 2016 tax year.)

Definitions:

Indigenous Peoples

Ethnic groups who are the original inhabitants of a given region, maintaining traditions or other aspects of an early culture that is associated with a given geographical region.

Australian Sites

Refers to locations of significance within Australia, including natural wonders, historical landmarks, and cultural sites.

Bisj Pole

A Bisj Pole is a ritual sculpture created by the Asmat people of New Guinea, typically carved from wood and decorated with symbolic carvings, intended to honor and appease the spirits of ancestors.

Asmat Society

An ethnic group in Papua, Indonesia, known for their intricate wood carvings and significant cultural practices related to ancestry and the spiritual world.

Q1: A public corporation earns $500,000 in pre-tax

Q74: Team members with good listening, feedback, and

Q76: One-on-one psychotherapy for people with schizophrenia<br>A) seems

Q100: Competitive reward structures reinforce the importance of

Q101: In a_ team the manager's job becomes

Q104: If Ahmed is apprehensive regarding oral communication,

Q118: What are the major symptoms of autism?

Q120: In genetic studies, a "proband" or "index

Q124: In the second stage of group development_

Q126: How do early views of child psychopathology