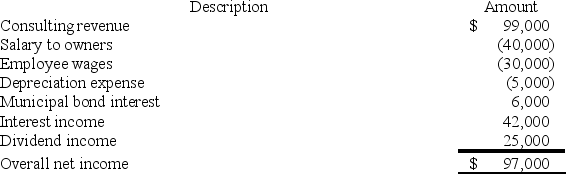

RGD Corporation was a C corporation from its inception in 2014 through 2018. However, it elected S corporation status effective January 1, 2019. RGD had $50,000 of earnings and profits at the end of 2018. RGD reported the following information for its 2019 tax year.

What amount of excess net passive income tax is RGD liable for in 2019? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2019? Assume the corporate tax rate is 21%.

Definitions:

Business Products

Products organizations buy that assist in providing other products for resale. Also called B2B products or industrial products.

Indirect Marketing Channel

A pathway of distribution involving one or more intermediaries (such as wholesalers or retailers) between the producer and the consumer.

Intermediaries

Entities or individuals that act as a middleman in the distribution chain between producer and end-user, facilitating transactions or dissemination of products.

Distribution

The process by which goods are transported from the producer or supplier to the consumer or retail outlet.

Q18: Appleton Corporation, a U.S. corporation, reported total

Q56: Clampett, Inc., has been an S corporation

Q76: Assume Tennis Pro attends a sports equipment

Q80: Tom is talking to his friend Bob,

Q81: S corporation shareholders are not allowed to

Q82: Roxy operates a dress shop in Arlington,

Q82: ASC 740 applies to accounting for state,

Q82: Which statement best describes the concept of

Q102: RGD Corporation was a C corporation from

Q103: The debts of the decedent at the