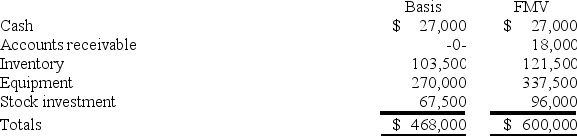

Victor is a one-third partner in the VRX Partnership, with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1 for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Adjourning

The final phase in group development where the team completes its tasks and disbands, typically associated with project teams or temporary committees.

Team Process

The sequence of actions, interactions, and methods used by a team to achieve its goals and objectives.

Working Relationships

Professional connections between individuals in a work environment that facilitate collaboration and the achievement of common goals.

Inputs into Outputs

The process of transforming resources, information, or efforts into finished goods or desired results.

Q2: The same exact requirements for forming and

Q14: Lafayette, Inc., completed its first year of

Q41: On January 1, 20X9, Mr. Blue and

Q49: The specific identification method is a method

Q58: Daniela is a 25 percent partner in

Q68: Doris owns a one-third capital and profits

Q70: Built-in gains recognized 15 years after a

Q74: Any losses that exceed the tax basis

Q93: Daniel acquires a 30 percent interest in

Q100: The PW Partnership's balance sheet includes the