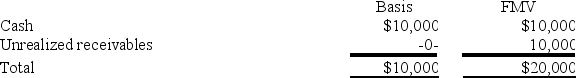

The PW Partnership's balance sheet includes the following assets immediately before it liquidates:  In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners) . Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

In complete liquidation, PW distributes the cash to Pamela and the unrealized receivables to Wade (equal partners) . Pamela and Wade each have an outside basis in PW equal to $5,000. PW has no liabilities at the time of the liquidation. What is the amount and character of Wade's recognized gain or loss?

Definitions:

Appreciative Inquiry

An approach to organizational change focusing on identifying what works well, analyzing why it works well, and then doing more of it.

Dreaming

A series of thoughts, images, or emotions occurring during sleep, particularly during REM sleep, reflecting complex cognitive processes.

Action Research

A participative and collaborative method of inquiry that involves a cycle of reflection, planning, action, and evaluation to solve problems or improve practices within communities or organizations.

Problem-focused

An approach aimed directly at eliminating or managing the source of a problem, as opposed to strategies that manage the symptoms or consequences.

Q9: Orono Corporation manufactured inventory in the United

Q25: Grand River Corporation reported pretax book income

Q32: Ashley transfers property with a tax basis

Q42: Superior Corporation reported taxable income of $1,000,000

Q50: Partners must generally treat the value of

Q56: Tyson, a one-quarter partner in the TF

Q68: Sophia is single and owns the following

Q71: Income earned by flow-through entities is usually

Q96: Publicly traded companies usually file their financial

Q112: Handsome Rob provides transportation services in several