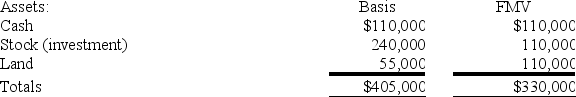

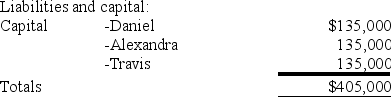

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and are considered variable costs.

Factory Depreciation

The systematic reduction in the recorded cost of fixed assets (such as manufacturing equipment) to account for wear and tear or obsolescence over time.

Total Manufacturing Costs

The aggregate cost of direct material, direct labor, and manufacturing overhead incurred in producing goods.

Operating Expenses

Operating expenses consist of the costs related to a company's primary operational activities, excluding costs associated with manufacturing or production.

Q8: Kedzie Company determined that the book basis

Q12: At the end of last year, Cynthia,

Q44: Half Moon Corporation made a distribution of

Q61: Whitman Corporation reported pretax book income of

Q73: This year, Reggie's distributive share from Almonte

Q83: To be eligible for the "closer connection"

Q85: This year, Brent by himself purchased season

Q98: Sue transferred 100 percent of her stock

Q104: Which of the following statements regarding the

Q105: Like partnerships, S corporations generally determine their