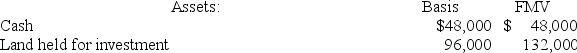

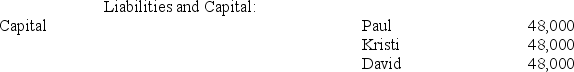

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Immune System

The body's defense system against infections, diseases, and other potentially damaging foreign bodies.

Restless Legs Syndrome

A neurological disorder characterized by an irresistible urge to move the legs, often accompanied by uncomfortable sensations.

DSM-5

The fifth edition of the Diagnostic and Statistical Manual of Mental Disorders, a handbook used by healthcare professionals as the authoritative guide to diagnosing mental disorders.

REM Sleep

A sleep phase characterized by rapid eye movement, increased brain activity, vivid dreams, and temporary muscle paralysis.

Q57: Tatoo Inc. reported a net capital loss

Q64: A corporation may carry a net capital

Q66: Ozark Corporation reported taxable income of $500,000

Q68: Orange Inc. issued 20,000 nonqualified stock options

Q69: Partnerships can use special allocations to shift

Q76: Sweetwater Corporation declared a stock distribution to

Q78: Jalen transferred his 10 percent interest to

Q81: Harry and Sally formed Empire Corporation on

Q85: It is important to distinguish between temporary

Q100: The PW Partnership's balance sheet includes the