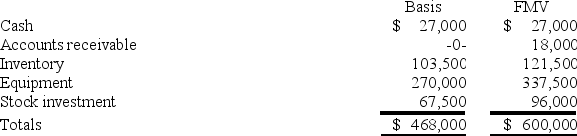

Zayde is a one-third partner in the ARZ Partnership, with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1 for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Definitions:

Teams Competency

The collective knowledge, skills, and abilities that contribute to a team's ability to achieve its goals effectively.

Individualism/Collectivism

A cultural dimension that describes whether people in a society are integrated into strong, cohesive in-groups (collectivism) or act as independent, self-reliant individuals (individualism).

Conflict

A serious disagreement or argument, typically a protracted one, which can occur between individuals, groups, or nations.

Motive

A reason for doing something, especially one that is hidden or not obvious.

Q8: The generation-skipping tax is designed to accomplish

Q8: A distribution in partial liquidation of a

Q55: U.S. corporations are eligible for a foreign

Q61: The term "E&P" is well-defined in the

Q64: A liquidation of a corporation always is

Q73: Comet Company is owned equally by Pat

Q87: Bingo Corporation incurred a $10 million net

Q89: When determining a partner's gain on the

Q95: Hector formed H Corporation as a C

Q98: Clampett, Inc., converted to an S corporation