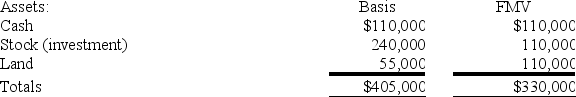

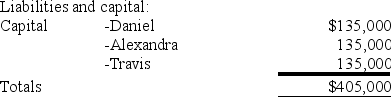

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Classical Conditioning

A training mechanism where pairing two stimuli repeatedly leads to a response initially produced by the second stimulus being eventually produced by the first stimulus.

Intense Fear

A powerful and overwhelming emotion caused by the perception of imminent danger, threat, or pain.

Dog Phobia

An intense, irrational fear of dogs, categorized under specific phobias that significantly impact a person's daily life.

Conditioned Response

A learned response to a previously neutral stimulus that becomes conditioned after being associated with an unconditioned stimulus in classical conditioning.

Q7: A non-U.S. citizen with a green card

Q17: S corporation distributions of cash are not

Q18: A partner that receives cash in an

Q30: Erica and Brett decide to form their

Q31: Keegan incorporated his sole proprietorship by transferring

Q38: An S corporation shareholder's allocable share of

Q43: Under what conditions will a partner recognize

Q57: The Canadian government imposes a withholding tax

Q59: Which of the following statements regarding a

Q95: Jordan, Inc., Bird, Inc., Ewing, Inc., and