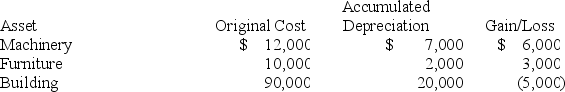

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Unlevered Firm

A firm that operates without any debt in its capital structure, using only equity for financing.

After-Tax Net Income

The amount of money that remains after all taxes have been deducted from a company's gross income.

Unlevered Cost of Capital

The cost of capital for a company without any debt, reflecting the required return on equity investments in a firm without leverage.

All Equity Firm

A company that finances its operations without any debt, using only its own equity.

Q6: Taxpayers use the half-year convention for all

Q15: Evergreen Corporation distributes land with a fair

Q16: S corporation shareholders are subject to self-employment

Q18: Which of the following are values shared

Q24: Net capital loss carryovers are deductible against

Q33: Clyde operates a sole proprietorship using the

Q36: Joe operates a plumbing business that uses

Q41: Brad sold a rental house that he

Q79: Which of the following is not true

Q93: Boxer LLC has acquired various types of