Figure 4

Figure 4

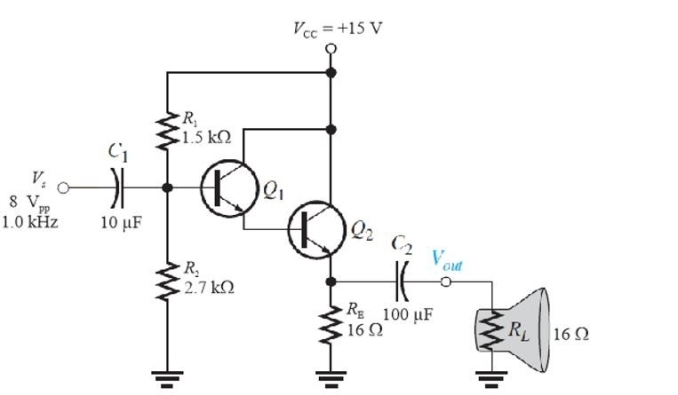

-Compare Figure 4 to Figure 3. The two- transistor circuit in Figure 4 has

Definitions:

Time Value of Money

The concept that money available now is worth more than the same amount in the future due to its potential earning capacity.

Net Present Value Method

A financial analysis technique used to assess the profitability of an investment by calculating the difference between the present value of cash inflows and outflows.

Future Cash Inflows

Expected cash receipts or revenues generated from business activities in future periods.

Rate of Return

The gain or loss of an investment over a specified period, expressed as a percentage of the investment’s cost.

Q1: Refer to Figure 5. The response labeled

Q6: Refer to Figure 3. Assume the unloaded

Q11: The best response to use for pulses

Q16: Refer to Figure 2. If the load

Q23: Who funds the Better Business Bureau?<br>A)the government<br>B)businesses<br>C)taxes<br>D)advertising

Q28: Refer to Figure 1. The output of

Q31: The fastest growing type of fraud is

Q33: A certain MOSFET has IDSS = 6

Q34: Monopoly means<br>A)the consumer is king.<br>B)let the buyer

Q42: Refer to Figure 2. The voltage gain