Multiple Choice

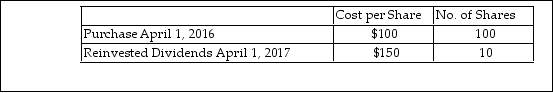

Rachel holds 110 shares of Argon Mutual Fund. She is planning to sell 90 shares. Her record of the share purchas noted below. What could be her basis for the 90 shares to be sold for purposes of determining gain?

Definitions:

Related Questions

Q352: Corner Grocery, Inc., a C corporation with

Q401: Three years ago, Myriah refinanced her home

Q543: Liz, who is single in 2018, lives

Q636: Expenses incurred in a trade or business

Q753: Tess has started a new part- time

Q825: Which of the following conditions would generally

Q1120: While points paid to purchase a residence

Q1355: A net operating loss (NOL) occurs when

Q1643: Johanna is single and self- employed as

Q2018: Ellie, a CPA, incurred the following deductible